Understanding Your Trading Needs and Preferences

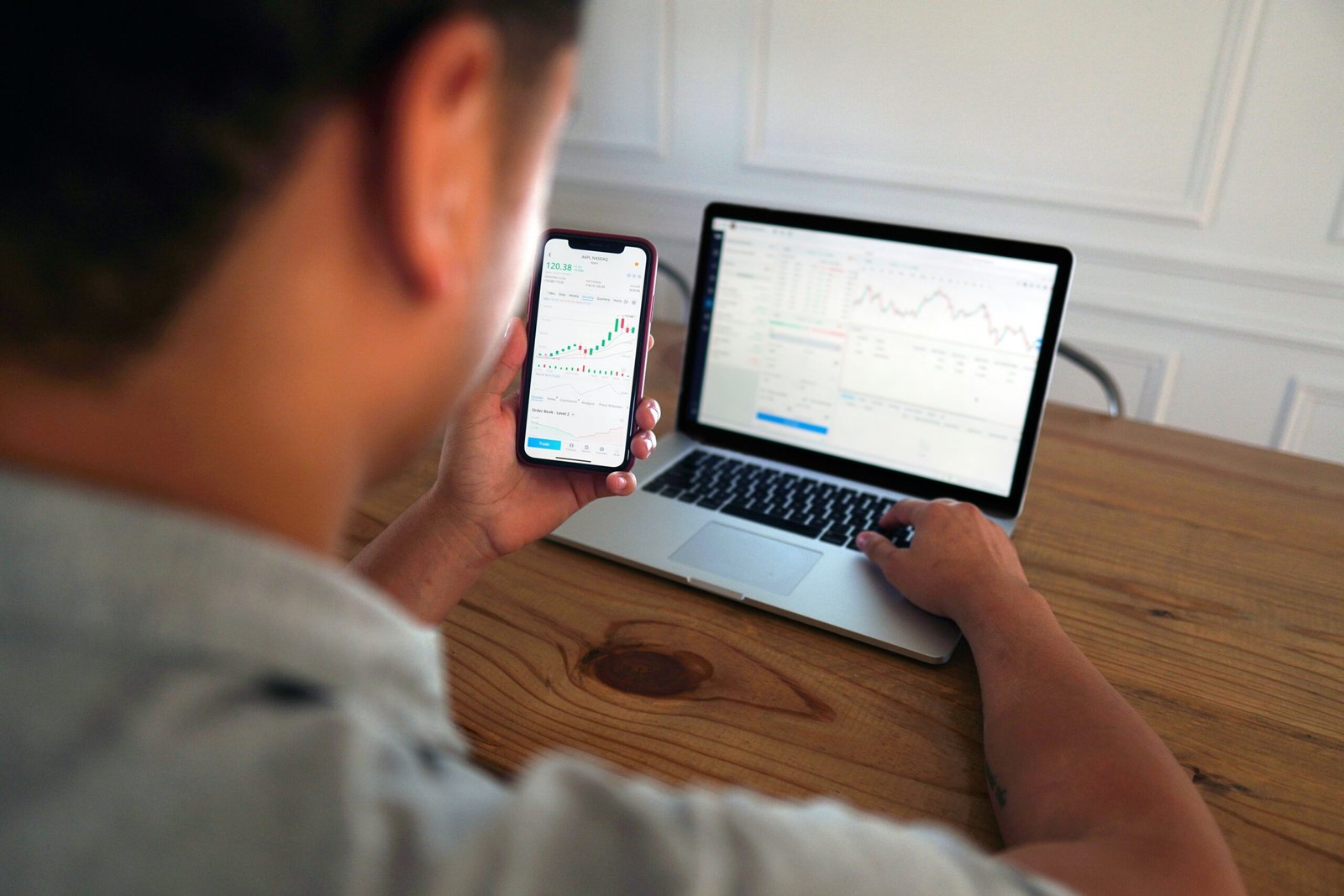

When evaluating forex brokers, it is critical for Indonesian investors to first identify their individual trading styles and preferences. Your personal trading style may include day trading, scalping, swing trading, or adopting a long-term investment strategy. Each of these styles demands varying levels of engagement and time commitment, thus influencing the choice of a broker. For instance, day traders often require real-time data and quick execution speeds, while swing traders may prioritize analytical tools that assist in observing market trends.

Budget considerations also play a significant role in the decision-making process. Investors must assess how much capital they are willing to allocate to forex trading, as this can determine the types of accounts and services they seek from brokers. Some may require accounts with low minimum deposits, while others may prefer brokers that offer high leverage options to maximize their trading potential. Understanding your budget will help you narrow down choices and find a broker that offers the most suitable services without incurring excessive costs.

Risk tolerance is another essential factor. It is vital to evaluate how much risk you are willing to take on in relation to your trading endeavors. Some brokers provide various trading tools and account features that cater to risk management preferences, such as stop-loss orders and negative balance protection. Identifying a broker that aligns with your risk tolerance will enhance your overall trading experience.

Additionally, an understanding of the trading platforms, tools, and resources offered by different brokers is necessary to support your specific trading strategies. Quality platforms often provide charts, analytical tools, and educational resources, which can significantly ease the learning curve for novice traders and enhance the proficiency of experienced ones.

Incorporating Trader Feedback for Comprehensive Broker Evaluations

When evaluating forex brokers, the incorporation of feedback from actual traders is paramount for creating a comprehensive understanding of the broker landscape. Traders’ insights are instrumental in revealing the practical experiences that individuals have had with various brokers, which often contribute more significantly than promotional materials. By gathering and analyzing user experiences, it is possible to highlight satisfaction levels, common pain points, and specific features that resonate with or frustrate traders. This makes it easier for prospective investors to make informed decisions tailored to their unique needs.

To effectively assess a broker’s credibility and efficiency, it is important to curate a diverse range of trader feedback. This involves reaching out to different trading communities and gathering opinions from investors with varying degrees of experience. Such validation aids in identifying brokers who excel in certain areas, such as customer support, trading platforms, education resources, and overall execution quality. Furthermore, documenting the insights gathered allows for a more balanced assessment. Consequently, each broker can be evaluated against a set of established criteria based on trader satisfaction and dissatisfaction.

Another key aspect of this evaluation process is the consideration of brokers that accommodate varying budgets and trading preferences. Some traders may prioritize low transaction fees, while others may focus on robust educational resources or advanced trading tools. By analyzing feedback related to these diverse factors, it is possible to compile broker recommendations that reflect a wide spectrum of trading styles and financial situations. This nuanced approach ensures that traders, regardless of their experience, find a broker that aligns with their individual trading strategies. Ultimately, the incorporation of trader feedback enhances the reliability of broker evaluations and recommendations, providing a clearer path for investors navigating the forex market.

0 Comments